Volkswagen set to snatch Tesla’s EV sales crown by 2024: report

Volkswagen will be the world’s top selling electric vehicle manufacturer by 2024, according to new analysis by Bloomberg Intelligence.

That’s one year later than the analytics giant previously forecast but still represents impressive growth in the fast developing EV space.

The report titled BI Global Battery-Electric Vehicles: Race to the Top states Volkswagen is “poised to take pole position in the BEV race” off the back of a rush of new models.

It also says Volkswagen and Tesla have a clear advantage over traditional car makers, claiming that “peers lag behind”.

Key to Volkswagen’s predicted EV sales growth is its broad range of brands – including Audi, Skoda, Porsche and Bentley – all of which are planning big things for electric cars. Volkswagen is also planning on bringing back some big names with an EV twist; they include the relaunch of Scout and a born-again electric Kombi known as the ID.Buzz (pictured at the top of this article).

“VW’s plan could herald a fundamental shift toward battery electric vehicles, using its global scale to achieve the top end of its new 8-9% 2025 Ebit-margin target early, ahead of consensus,” the report states.

While Volkswagen doesn’t yet sell any EVs in Australia, it has committed to the upcoming Cupra Born, Skoda Enyaq and Volkswagen ID.4 and has plans for a broader EV attack.

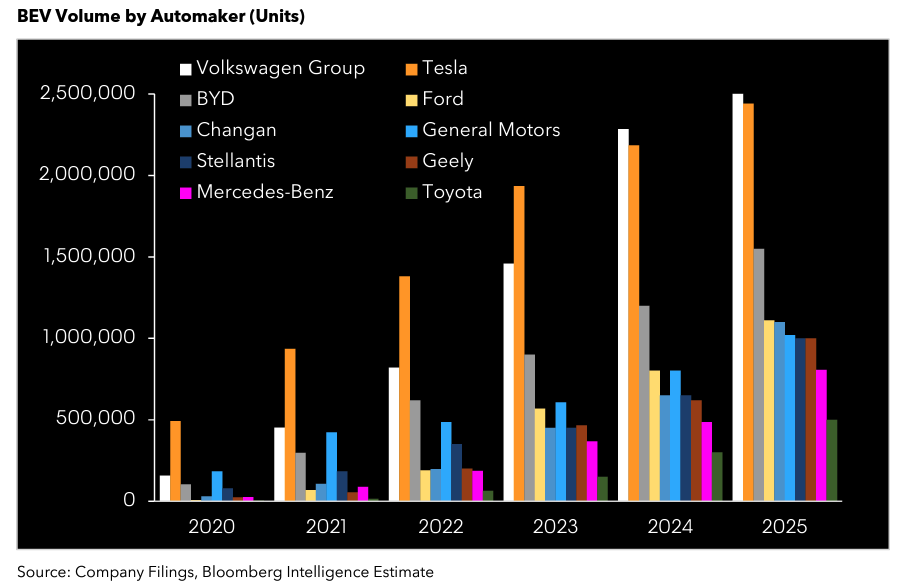

A graph published in the Bloomberg Intelligence report estimates Tesla posting solid growth over the next few years but Volkswagen overtaking it in 2024 and staying just ahead in 2025 with a forecast of about 2.5 million vehicles – only just ahead of Tesla.

Tesla Cybertruck: expect more delays

The Bloomberg report predicts Tesla will sell about two million vehicles in 2023, double what it did in 2021.

However, that assumes Tesla manages to get the Cybertruck electric ute onto the market by then, something Bloomberg says is “questionable”.

READ MORE: EV ute overload: The electric pick-up trucks coming soon

Tesla typically runs months or years behind its publicly stated launch plans; the Cybertruck was initially planned to enter production late in 2021 but has been pushed back until at least 2023; despite Tesla taking early orders it now appears unlikely the Cybertruck will go on sale in Australia.

New world order

Bloomberg predicts Chinese juggernaut BYD – which launches in Australia soon with the Atto 3 – will be third with around 1.5 million sales in 2025.

From there there’s a bunch of brands hovering around the one million annual sales, including Ford, Changan, General Motors, Stellantis (which includes Jeep, Peugeot, Opel, Fiat and more) and Geely (owner of Volvo and Polestar).

Bloomberg predicts the world’s largest car maker, Toyota, will still be way off the EV pace by 2025 with around 500,000 sales; late in 2021 Toyota detailed its plans to tackle the growing interest in EVs. However, it acknowledges that “Toyota is accelerating a BEV and FCEV sales push”, something that will even extend to the LandCruiser off-roader.

Bloomberg said it expects Japanese car makers to ramp up their EV sales in the second half of the decade.

“Japanese automakers’ strategies to electrify their vehicles reflect local regulations, incentives, energy mixes and consumer preferences,” said the Bloomberg Intelligence report, referencing the focus of many brands on hybrid electric vehicles (HEV).

“We believe their focus is shifting gradually from HEVs to BEVs, but that the latter will gain significant momentum only from 2026 onwards.”

Don’t expect EV newcomers to mimic Tesla

Tesla has been the world’s top-selling EV brand since the arrival of the Model 3 in 2019 and the soon-to-arrive-in-Australia Model Y is playing a big role in its growth.

It has not look challenged since as traditional brands scramble to catch up to its dominant lead; in Australia Tesla accounts for about two-thirds of EV sales.

While Tesla has shaped the global shift to EVs, the Bloomberg Intelligence report doesn’t expect other electric car start-ups to have anything like the same impact.

It says EV “pure-plays lack production heft to challenge legacies”.

In particular, it highlights the recent supply chain and economic challenges and nominates Rivian and Lucid as two brands feeling the brunt of those issues.

“Rivian and Lucid are yet to be profitable at the gross line, with the challenges of achieving scale intensifying in unfavourable macroeconomic and industry environments compounded by competing with established brands in a contracting market.”

Either way, expect an interesting EV battle over the next few years as brands across the globe compete in what is a booming market.