Mercedes-Benz says EVs heading towards big profits by 2030

EVs may be the darlings of the new car market but at the moment they’re a necessary drain on the bottom line of many car makers.

Car makers are pouring billions into the development of new electric vehicles as buyers increasingly demand them – but making money out of them isn’t always easy. Even Tesla loses money on its cars, only posting a profit in 2020 off the back of regulatory credits it received from rival car makers.

But Mercedes-Benz believes it will be making as much from its electric cars as it currently does from its ICE-powered machines by 2030.

Daimler chief Ola Kallenius made the predictions in an interview with UK publication The Financial Times.

In nominating the 2030 time frame he told the FT the “task is to take the healthy business model of today and to prove to ourselves and to the financial markets that we can have healthy returns when we become a dominant electric company.”

Mercedes-Benz has already said its upcoming EQS and other “high-end” electric models are targeting “solid profitability” from the start of production.

Kallenius also seems to think electric mobility is where the future is, saying that “even if you don’t know technology, subliminally you understand you’re sitting in something that is superior”.

In 2020 7.4 percent of the nearly 2.2 million vehicles Daimler produced were electric or plug-in hybrids – xEVs, as Mercedes-Benz refers to them – with plans to increase that to 31 percent in 2021. Mercedes-Benz plans to up that xEV share to at least 50 percent by 2030, many of which will come from the more than 20 planned battery electric vehicles the company hopes to be selling by then.

During 2021 Mercedes-Benz is planning to add four new EVs to its portfolio – EQA, EQB, EQE and EQS – the next tranche in a rapidly expanding EV range.

Mercedes-Benz’s EV strategy includes electric versions of existing models, including the EQC that arrived in 2019 and the upcoming EQA and EQB. The EQC is based on the GLC while the EQA and EQB are based on the GLA and GLB respectively. Using an existing architecture brings packaging compromises because the batteries and electric motors have to take the place of an engine, transmission and fuel tank, but it allows manufacturing flexibility that Benz argues is crucial in the transition between petrol and electricity.

But there will also be many Mercedes-Benz EV models built on dedicated electric car architectures. They include the new large electric platform (known as EVA) that will spawn the EQS, EQE, EQS SUV and EQE SUV.

There’s also the mid-sized electric platform (known as MMA) that is also planned to underpin at least five yet-to-be-announced future electric cars.

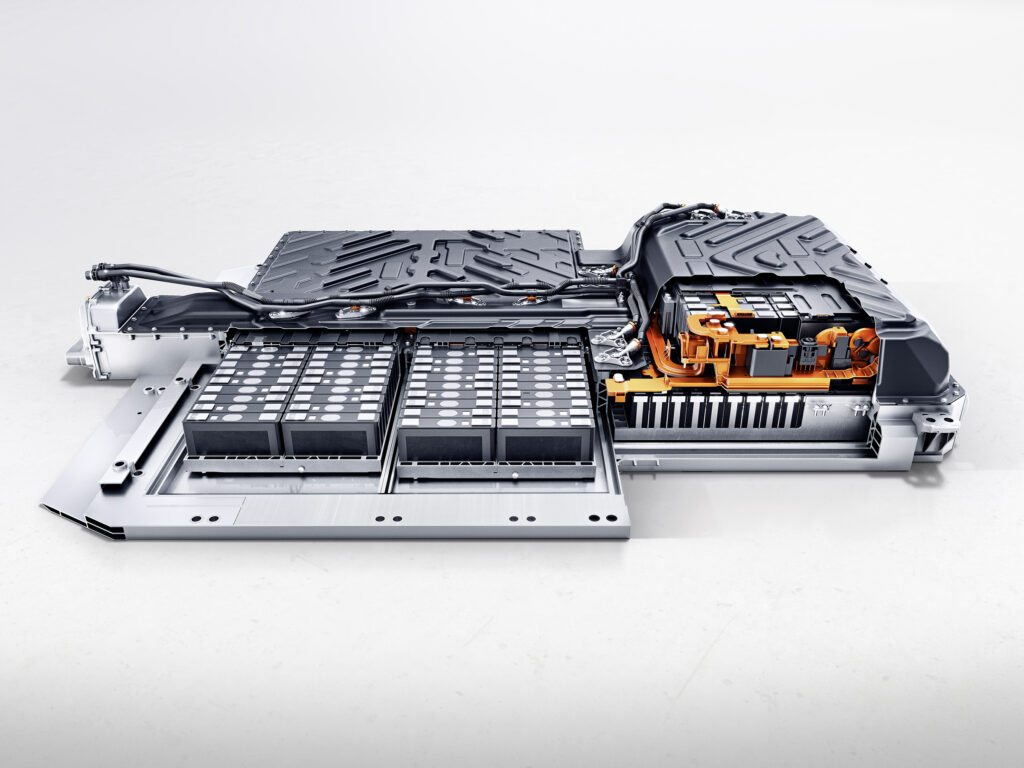

Key to the Daimler/Mercedes-Benz EV profitability picture are reduced manufacturing costs, with batteries in the crosshairs; batteries are the most expensive component of an EV.

Last year Daimler predicted battery costs would more than halve by 2021 to below €100 ($160) per kilowatt-hour.

Assuming battery capacities of 60kWh to 100kWh that would make the raw battery cost between $9600 and $16,000 per car.

That’s a significant chunk of any new car but is something easier to disguise at the premium end of the market.

Kallenius’ comments appear partially aimed at reassuring stock markets that it has made the right choice to invest big in EVs.

In a statement last year Kallenius said the company would “invest where we can win, grow more intelligently, and reshape our industrial footprint.”

In other words, Mercedes-Benz – the new company name for Mercedes-Benz passenger cars, instead of the current Daimler company name – believes EVs are its future and crucial to changing more than a century of car making history.