Battery swap tech being developed by big motorbike brands

Motorbike manufacturers Yamaha, Honda, KTM and Piaggio have agreed to work on a swappable battery system for future electric bikes.

The four motorcycle giants have signed a letter of intent to develop a Swappable Batteries Consortium for Motorcycles and Light Electric Vehicles.

The deal is an indication of where the brands see the motorbike market heading over the coming decade: electric.

“With the signing of this letter of intent the signatories show their proactiveness vis-a-vis the major concerns of their customers and the political priorities as regards the electrification of vehicles,” said Michele Colaninno, Piaggio Group Chief of strategy and product.

“An international standard for the swappable batteries system will make this technology efficient and at the disposal of the consumers. Finally a strengthened cooperation among manufacturers and institutions will allow the industry to better respond to the main challenges of the future of mobility.”

While electric motorbikes have been rare until now – Harley Davidson is the most prominent of the big brands to offer an electric bike, plus there have been numerous small brands – they’re clearly on the radar of the big manufacturers.

The battery swap would allow quick swaps similar to those used by all major power tool brands.

However, whereas power tool brands all have unique plugs – limiting the batteries to that particular brand – having a standard would allow swapping between brands.

A battery swap system would not only allow quick charges by swapping rather than plugging in but also upgrades as battery chemistry and technology improved.

As well as motorbikes, the battery swap system could be used in quad bikes and side-by-side buggies.

Honda appears to be one of the driving forces behind the battery swap consortium.

It first flagged the possibility of battery swapping back in 2018 and has even trialled the technology on the Phillipine island of Romblon.

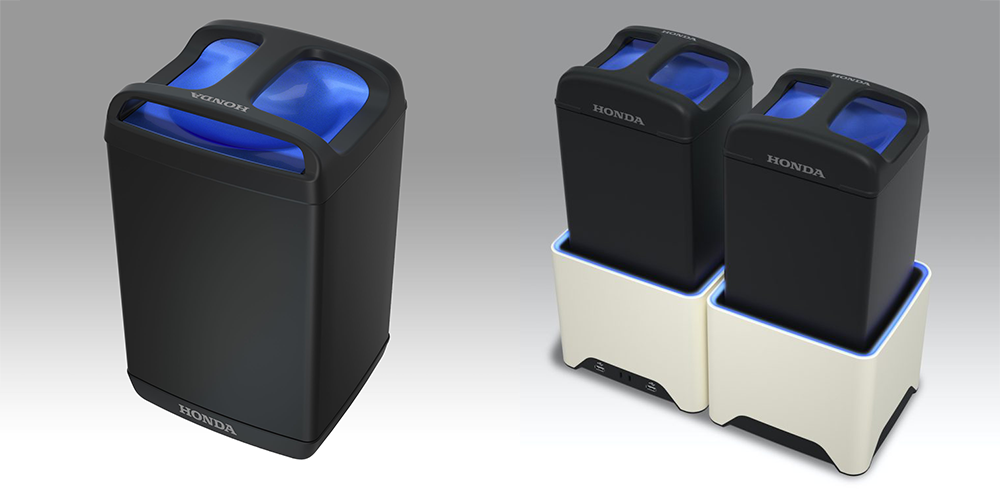

The Honda Mobile Power Pack was designed to capture surplus energy for use later but also included a motorbike swap system.

“For a company like Honda, which has a large share of the global motorcycle market, motorcycle electrification is something we can’t avoid,” said Makoto Mitsukawa at the time, Honda’s chief engineer at the Honda Motorcycle R&D centre. “When developing the PCX Electric, we started with the premise that the battery would be swappable, as it offered a solution to issues such as limited range and battery charging wait time.”

There are questions as to why motorbike manufacturers would want to look at swapping batteries rather than charging using the ultra-rapid charge network that is being deployed around the world.

With the ability to charge much larger car batteries to full in 10 minutes or less, the smaller batteries in bikes would clearly be even quicker to charge.

And, of course, improving battery technology is working on higher energy density, better longevity and faster charging times.

Various car makers looked at battery swap technology but have since shelved it. Renault was the most prominent, promising the ability to quickly swap batteries, something that proved difficult and costly.

Chinese car maker Nio is the main EV manufacturer still using battery swap tech for its cars as part of a leasing program, something that so far works because of the scale of the market in China.