Australia’s lithium irony: Time to value-add as batteries boom

As Australia’s national anthem points out with a fabulously old-fashioned verb, “our home is girt by sea”. While the waves and the fish are nice to have, especially on a sunny Australia Day, the big money is in the line that follows…

“Our land abounds in nature’s gifts” it goes. We’re resource-rich, that’s for sure. Things the world wants are generously scattered throughout the nation. And though we’re living in a time of profound technological change, it doesn’t seem this will much alter the Lucky Country’s fortunes.

Did you know that Australia is the world’s leading supplier of lithium?

That’s right, we’re digging up more of the metal most needed to enable the EV transformation than anyone else.

In 2019, the most recent year for which figures are available, Australia easily topped the lithium-production charts. With 42,000 tonnes, extracted mainly from mines in West Australia, our production that year was more than double the 18,000 tonnes contributed by Chile.

Chile is the leading producer in what some call the Lithium Triangle, an area that includes parts of Argentina and Bolivia. While solar evaporation of lithium-rich brines is the technique commonly used in South America, Australia must do it differently.

Want the latest EV news and reviews delivered to your inbox? Subscribe to our weekly newsletter!

Our lithium is locked away in deposits of a mineral called spodumene, a name that will seem weird to anyone who’s not a geologist. The rock, which also contains aluminium and other elements, comes out of open-cut mines. Huge holes in the ground, basically.

Most of us wouldn’t know lithium if we tripped over a piece of it. That’s something that’s never going to happen, for a very simple reason. Pure lithium doesn’t exist naturally. Because it’s so chemically reactive, the very thing that makes it brilliant in batteries, lithium is always found bound-up with other elements in salts and rocks.

In contrast, Australia’s big-time resource success stories are more or less familiar. Resources make up more than 70 percent of our exports, according to the Federal Government. Six of them – iron ore, coal, natural gas, gold, aluminium and petroleum – are among the nation’s top 10 goods.

In total, the resources sector, together with mining services, makes up over 8 percent of the Australian economy.

While global demand for coal, petroleum and natural gas will surely decline in coming years, the switch to EVs and the renewable energy sources that must accompany the transformation will drive up demand for other resources.

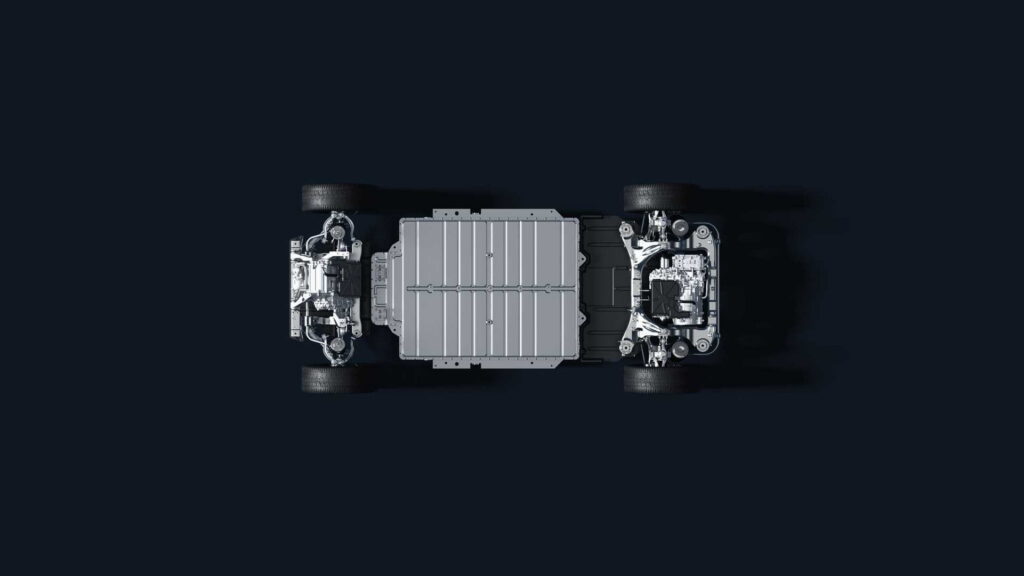

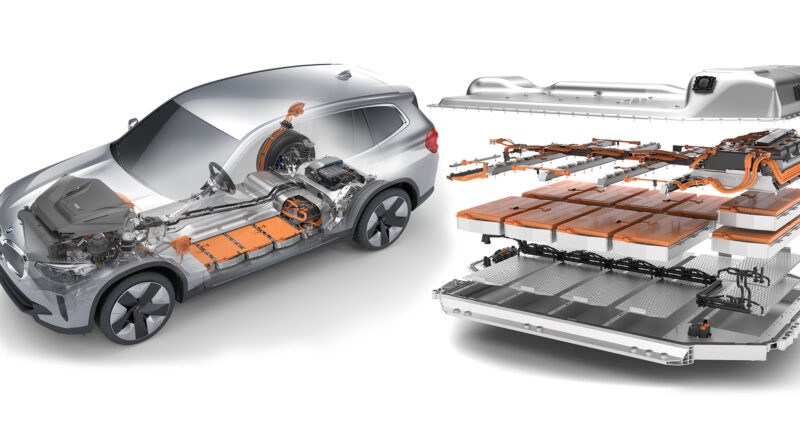

Lithium-ion batteries – the most expensive component of an EV – don’t actually contain very much lithium. It might be the key ingredient that gives them their name, but lithium-ion batteries also require lots of copper (for conductors), aluminium (for containers and casings), and nickel, manganese and cobalt (for electrodes). Also, the electric motors powered by lithium-ion batteries are made mainly from iron and copper.

It happens that Australia has all of these. We’re the world’s biggest producer of bauxite, from which aluminium is extracted, iron ore and, as mentioned earlier, lithium. And we’re second biggest in manganese, fourth biggest in cobalt, fifth biggest in nickel and sixth biggest in copper.

So here’s a thought for Australia Day…

Might it be a good idea to consider as a nation doing a little more with those abundant “nature’s gifts” mentioned in the anthem?

We’re world leaders when it comes to making great big holes in the ground where our minerals used to be. Surely there’s a way for us to also earn a slice of the profits made turning what comes out of those holes into products that are even more valuable.

The CSIRO sees huge potential. An in-depth study by two of its scientists, Adam Best and Chris Vernon, was released in 2020.

Produced for the Future Battery Industries Co-operative Research Centre, the almost 100-page document explores in great detail how much more we could do with our mineral wealth.

“Australia is well endowed with all the raw materials for the manufacture of batteries,” reads the first sentence of the study’s executive summary.

It then goes on to note that there is no production of battery-grade chemicals in Australia, no plants to engineer battery precursor materials, and no cell manufacturing.

While there is a growing activity in Australia in the field of battery manufacturing, all of the small number of outfits in it use imported cells.

Australia doesn’t lack technical expertise, the CSIRO authors note. What’s missing is planning and policies.

Until the situation changes, Australia’s slice of the lithium-ion battery boom action will remain minuscule. Globally the market is worth hundreds of billions, and it’s growing fast.

But as a supplier of raw materials, and nothing more, Australia’s share of the bounty is only around 0.5 percent of the total…

Excellent article John. May I suggest you forward this essay on to the Federal Government, especially the relevant minister. Maybe they might stop sitting on their hands and do something for a change about this technology and electric cars.

Australia has always had so much potential. As time goes by, that potential continues to increase but is never met. About export of all these ores and raw materials, it’s not “We” that do it but “They”, being transnational alpha predators, incentivised with free infrastructure and more tax exemptions than Catholic church. Which is best, Free Trade Policy or export destination countries with Manufacturing Policy? The book Trillion Dollar Baby by Phil Cleary explains how Norway actually got brave enough to make joint ventures of all big projects with at least 51% ownership by State. Of course, everybody said it couldn’t possibly be acceptable for North Sea Gas but hasn’t it been a huge success? No chance of anything like this in the unLucky Country!